Reviews and research have shown that programmatic acquirers are more successful in increasing shareholder value than their peer group. Let’s take a look at some of the drivers.

Programmatic buyers actively pursue acquisitions as a key component of their growth strategy. They acquire regularly, and usually close two or more deals per year. The target companies’ combined sales or market capitalization can be considerable in relation to the buyer’s. In other words: Programmatic buyers know what they are doing, and why.

Programmatic buyers show M&A success is not random. It is plannable, sustainable, and can be a continuous source of growing shareholder value if done correctly. Programmatic buyers do not treat M&A like a project, but rather like a program. The difference is that projects are singular, non-repetitive endeavors, which may follow certain common rules, but those are in general non-systematic. A program prescribes a flow, following a pre-defined governance and given parameters. A program is never ad-hoc.

Rule #2: Successful acquirers follow a pre-defined program

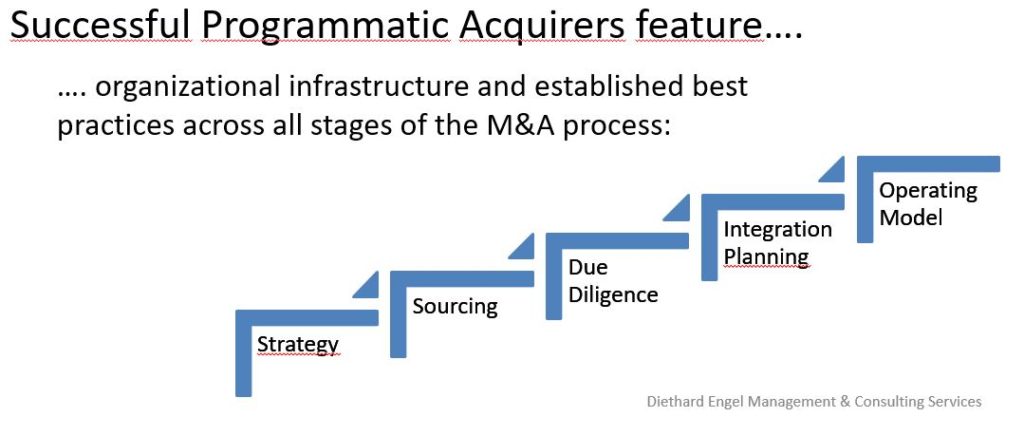

The programmatic acquirer features a detailed M&A operating model, which allows following through on the complete process from strategy to operating model of the combined business.

The end-to-end M&A operating model includes clear performance measures, incentives, and governance processes. For example, potential acquisitions are not ad-hoc evaluated; instead any evaluation is based upon a pre-defined model, with clear parameters and decision criteria. Ideally, there is a regular feed of data into a potential target pipeline.

Unless a potential acquirer can point to such program, it is recommended to use expert advice already in the pre-deal phase. M&A experts will bring the experience to the table, which the prospect buyer cannot have, lacking the routine in the acquisition process. However, any internal expertise can be build, by hiring experienced personnel, or by using external know-how initially.

In case you have missed the previous article in the series “Inside Post-merger Integration”, it can be found here.

Diethard Engel is an independent consultant and interim manager, focused on Business Transformation, Post-merger Integration / Carve-out and Executive Finance in the manufacturing industry. He has run multiple post-merger integration/carve-out projects for international businesses.

2 Gedanken zu „Inside Post-merger Integration (2): Programmatic Acquirers“

Kommentare sind geschlossen.