An acquisition target has been identified, and the strategic fit confirmed. What’s next?

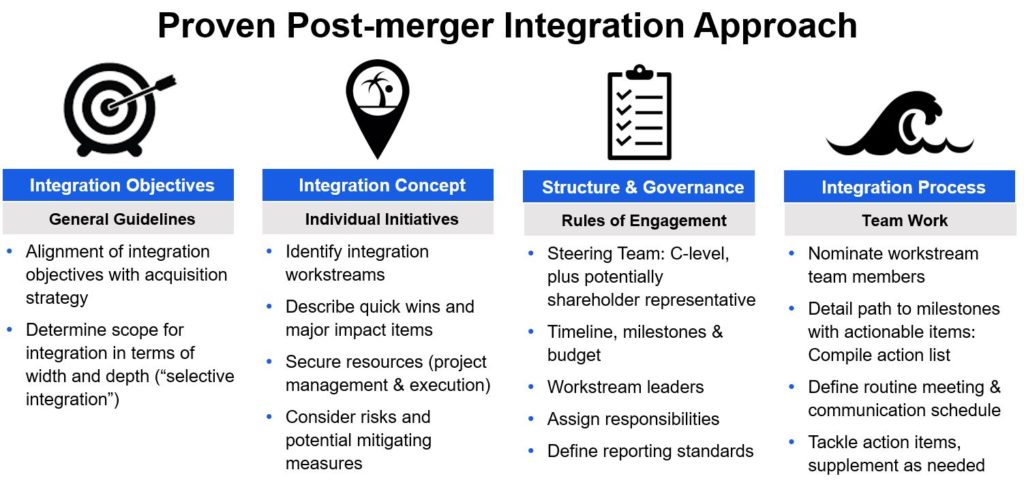

M&A is people business: While the buyer also acquires assets (material and immaterial), it’s people who make things work, or not. The PMI Manager got to have backing and a good standing in both organizations, buyer and target. Hence, building relationships on senior level is a must. While many PMI Managers are tempted to start out with a host of project management tools they plan to deploy, demonstrating their technical capabilities, gaining commitment is the crucial step: Senior Management got to agree to, and be in support of, the general steps of developing the integration plan.

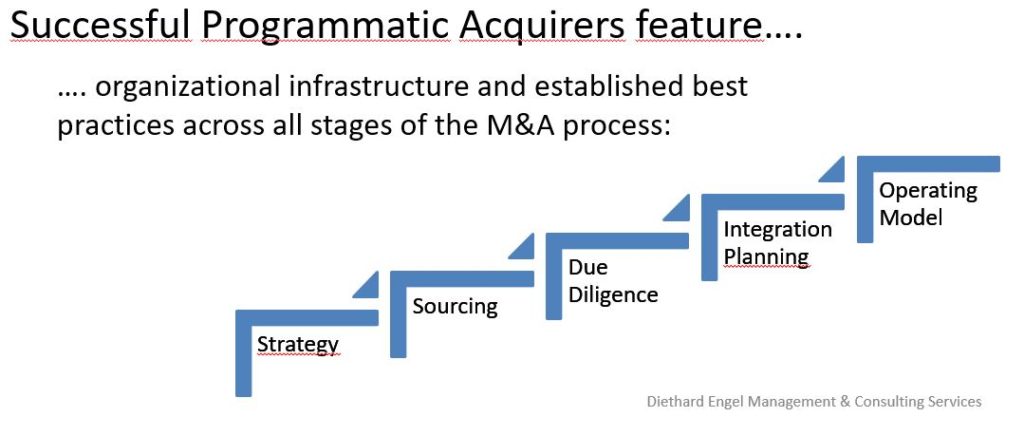

Once the path towards integration planning has been paved, the integration itself is moving into the focus of activities. Successful acquirers plan integration simultaneous to their due diligence, in fact: Integration planning is an integral part of due diligence.

Good thing is, not everything got to be integrated. Identification of those functions or parts of the business which are to be integrated should be driven by the acquirer’s business strategy and the linked desired benefits. This leads to

Rule #3: Keep it simple.

Full integration – all functions, all systems – is rarely required to reap the benefits of an acquisition. In fact, performing integration activities besides running a day-to-day business will eat deeply into resources, in both the target and the buyer. Hence, it is recommended to keep integration focused on those areas which are most promising in terms of benefits delivery, while balancing integration risk. Backoffice integration (Finance, HR) is often on top of the list (recognized as “low hanging fruit”), but integration of core functions, Sales and Marketing before all, usually offers the highest reward (but take more efforts, too).

Functional leaders should be involved in developing the integration goals and in gauging potential benefits. A structured goal definition process from general deal benefits (e.g. “market access”) to detailed objectives (e.g. “sell N units of product A at price Y”) will demonstrate how benefits can be achieved, and what is needed to get there.

As a result of this process (which takes time – it’s not a one-day workshop), the acquirer will have a detailed list of benefits, measures and activities required to achieve them, and – maybe above all – Management agreement on both sides that this is what it takes to integrate successfully. The result of the process represents the Holy Grail of integration planning, the Target Operating Model (TOM). The TOM details what the future organization will look like, what will be integrated for which benefits, and – equally important – what will be left alone. The TOM gives a strategic, risk-balanced view on the future state of the joint operation; it will serve as the blueprint for integration, should the deal be closed.

In case you have missed the previous article in the series “Inside Post-merger Integration”, it can be found here.

Diethard Engel is an independent consultant and interim manager, focused on Business Transformation, Post-merger Integration / Carve-out and Executive Finance in the manufacturing industry. He has run multiple post-merger integration/carve-out projects for international businesses.