Synergy planning delivers key input for the valuation model to any acquirer buying a business for integration. Hence, effective synergy delivery is a key success factor in PMI.

Usually, acquirers buy a business at a price above its stand-alone value: Most buyers will want to apply changes to a business and improve it to justify the on-cost. Such changes are supposed to deliver financial benefits, a.k.a. synergies. Numerous integration projects show those businesses integrating core functions, such as Sales & Marketing, generate larger synergies than those concentrating on support functions, such as Finance & Accounting.

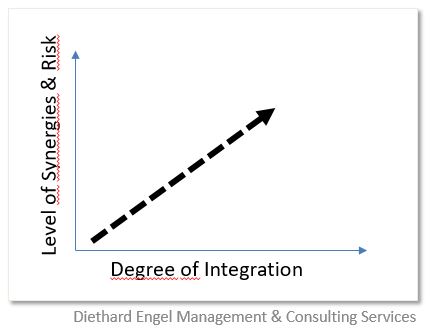

The Target Operating Model (TOM) developed pre-deal will largely prescribe which areas and functions shall be integrated, and when. Unfortunately, deep integration requires more effort, increases the risk, and takes more time. Many successful acquirers integrate select support functions swiftly, followed by more complex core functions after an extended preparation time.

By-and-large, synergies differentiate into customer-facing synergies (access to markets or customers, new technology for new products….) or those targeting reduction of expenses (material cost, people redundancies, infrastructure…). In any case, due to their importance in the acquisition’s financial model, synergy projects require measuring and follow-up. Since both value and timing of cash flows impact on ROI, each synergy project got to have a timeline and a clear set of KPIs attached to it. It does make sense to be sure that processes are in place to be able to measure those KPIs; KPIs that remain unmeasured are highly unlikely to be met. For example, where “New Products as % of Sales” has been defined as a KPI, one should know what exactly qualifies as a New Product Sale (totally new, new variant, existing product in new market, how long is a product new, when does measurement start….). Also, once the features of a KPI have been defined, a system (IT-based or not) should be in place to track these parameters, across both companies, buyer and target.

Rule #6: Deal targets are unlikely to be achieved without tracking.

Each synergy target should be supported by a timeline and a milestone plan. Milestones describe an event (status can only be “achieved”/”not achieved”), but not a course of action. Hence, each milestone need to be underpinned by action planning in a level of granularity allowing the functional owner to monitor progress adequately. Senior Management need to be updated routinely on synergy projects, progress and risk. At least sponsoring Senior Managers should be engaged, should use and share relevant KPIs consistently, regularly and openly. Synergy planning, measuring, monitoring and progress communication will increase the likelihood of achievement significantly.

Diethard Engel is an independent consultant and interim manager, focused on Business Transformation, Post-merger Integration / Carve-out and Executive Finance in the manufacturing industry. He has run multiple post-merger integration/carve-out projects for international businesses.

2 Gedanken zu „Inside Post-merger Integration (6): Synergies“

Die Kommentare sind geschlossen.