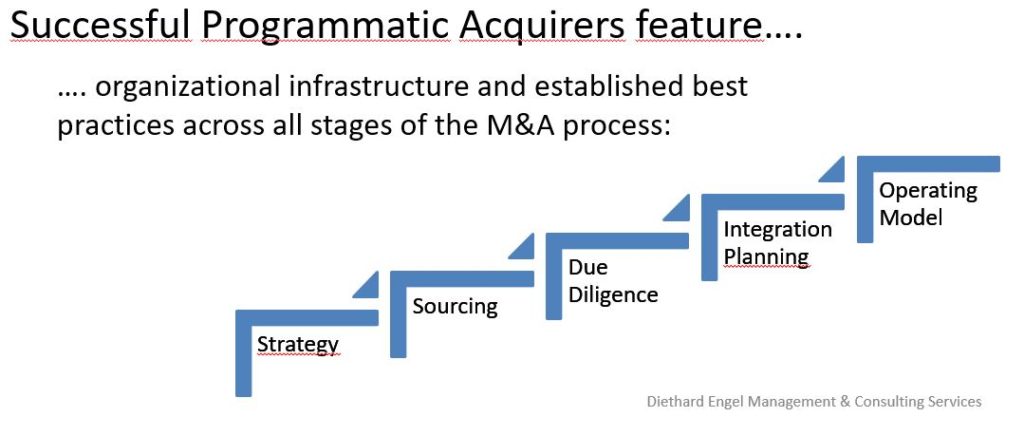

Most successful acquirers set up their M&A projects in a strong and controlled environment. Here is how they do it.

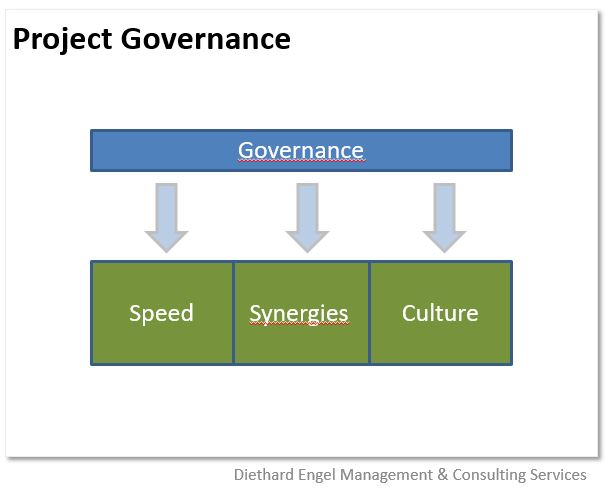

Empirics show that project governance is an enabler to unlock synergy achievement, hit (or beat) the integration timeline, and promote cultural integration, too. In that sense, project government is the glue that keeps the project whole and together. So, if the acquirer gets project governance right, the probability for hitting the original acquisition goals increases. (Some argue though that strong project governance is rather an indicator of being well organized, and that planning and organization would be the drivers of integration success in reality. For our purpose, this is an academic discussion because we will try to get all drivers of success equally right.)

Rule #5: Strong project governance enables integration success

Project governance defines roles and allocates responsibility and accountability. It also sets the rules of engagement, in particular how decisions are derived, and how the project is controlled to ensure efficient use of resources. Project governance rules should be set prior to close, and are usually formally acknowledged (and communicated) by the project’s steering committee.

The steering committee is the decision making body (a.k.a. Steering Group, Program Leadership Team….) which ideally includes representatives of both corporations, buyer and target, in a balanced way. Since steering committee decisions frequently have large impact, top-level management participation is mandatory. Other members are usually recruited from the general stakeholder group, including shareholders, potentially banks or representatives of the advisory board.

A constant flow of accurate information into the steering committee will drive early risk recognition, thus enable risk, and not issue, management. The most common conflicted subject is availability of resources to run the project and implement initiatives according to an agreed project plan. It is the steering committee’s responsibility to review, and in doubt change priorities or scope, reallocate resource as needed, change requirements, or timeline. Pre-defined reports and decision memo formats support busy managers in the evaluation of alternative scenarios for informed decision making.

Diethard Engel is an independent consultant and interim manager, focused on Business Transformation, Post-merger Integration / Carve-out and Executive Finance in the manufacturing industry. He has run multiple post-merger integration/carve-out projects for international businesses.