My friend Robert Heaton – well known to the M&A community for his podcast series on mergers and integration – and I discuss common M&A Pitfalls and how to avoid them in this podcast.

Listen in! (Links to LinkedIn and buzzsprout)

Interim Manager | Business Transformation | Post-merger Integration/Carve-out | Executive Finance

Value Creation mit Interim Management vom Experten

My friend Robert Heaton – well known to the M&A community for his podcast series on mergers and integration – and I discuss common M&A Pitfalls and how to avoid them in this podcast.

Listen in! (Links to LinkedIn and buzzsprout)

Following an acquisition, integration is no cakewalk. It is, in fact, much harder than signing the deal.

Unless you are a frequent acquirer, and have (successfully) completed a number of integrations, there is a high probability of being unsuccessful in realizing your strategic and financial acquisition goals: 50-70% of failed acquisitions (depending on who you ask) speak for themselves.

If you want to win a 10.000 meter-race, the keys to success lie in practice and creating the right conditions to excel. The same applies to acquisition and post-merger integration: A coach, training and repetition of the exercise increase the likelihood of a win tremendously.

If you are planning an acquisition, and view inorganic growth as an integral part of your strategy, internal capabilities will warrant a prosperous and rewarding program implementation. I will work with your M&A team to develop the right post-merger integration approach, and will train your team for future projects:

Even if your project seems off track already, it is not too late to fix it: Doing nothing is usually not the best option.

I have successfully completed multiple PMI projects and can help you to get to the finish-line, too.

Based out of Germany, Diethard Engel is an independent consultant and interim manager, focused on Business Transformation, Post-merger Integration / Carve-out and Executive Finance. He has run multiple post-merger integration/carve-out projects for international businesses.

Any post-merger integration project is a critical exercise – in case of failure it can take down entire corporations, or at least their management.

Remember the merger between the US carmaker Chrysler and the German manufacturer of luxury cars, Daimler? Daimler’s CEO, Hans-Jürgen Schrempp, celebrated the 38b DM-deal in 1998. After seven years of merger-struggle, he resigned in 2005. Eckhard Cordes, responsible for Daimler’s strategy, was earmarked as Schrempp’s successor, but left the Corporation after Dieter Zetsche had been nominated new CEO.

The merged business became unmerged again in 2007, and Private Equity firm Cerberus took over Chrysler. McKinsey estimated Schrempp’s damage to run at an unfathomable 74b US$, making this one of the top capital-destroying mergers ever.

The DaimlerChrysler merger of cause has been of gigantic dimension, however, the reasons for its failure are not uncommon at all: Cultural differences, incompatible strategies, management distraction, unclear integration focus – the same drivers letting post-merger integrations of all sizes fail (compare my blog contributions „M&A Pitfalls“).

Below the line, the way the CEO navigates PMI does not only define his contribution to value creation (be it positive or negative), but it defines him as a leader. Great leaders don’t only understand strategy, but they also nurture the necessary talent and know-how to implement it. Any post-merger integration is part of a critical strategic program, and should be treated as such. That’s why resourcing a PMI program with top people is a – if not the – critical success factor in PMI management (compare: Inside Post-merger Integration (4): Drivers of Success).

Based out of Germany, Diethard Engel is an independent consultant and interim manager, focused on Business Transformation, Post-merger Integration / Carve-out and Executive Finance. He has run multiple post-merger integration/carve-out projects for international businesses.

powered by digiweek M&A, June 14 –18, 2021

This week I am participating in a key event for the M&A community: M&A Digitization Week 2021. Players from software makers to consulting firms will present and discuss hot subjects from my line of business.

Digiweek M&A will be held for the first time this year in digital format from 14 to 18 June. The target group is all M&A professionals interested in tools and solutions to facilitate the M&A process.

The digiweek M&A is organised by M&A Media Services GmbH together with the content partners M&A REVIEW, German Association for Mergers & Acquisitions e.V. (BM&A) , Fusions & Acquisitions and M&A REVIEW EUROPE.

Decisions on people, their jobs and future are often the hardest. They have to be taken anyhow.

No one likes to communicate unpopular decisions, however, avoiding decisions on people and their future is not helpful in most cases, and certainly not in M&A scenarios. Yet, Management frequently chooses the easy way out and prefers to communicate that there will be no job loss with the merger. More often than not, that’s a promise which cannot be held up. (Also compare my contribution „Setting up Merger Communications“.)

Consolidation of functions and departments (HR, Finance….) usually goes along with a reduced resource need, starting from the heads of department, and ending with the lowest qualified positions. Duplicity of roles is commonly not warranted, neither under a cost perspective nor for organizational clarity. In the new setting of a combined business qualification requirements may change (in IT, for example). Also, holding people in undefined roles will lead to frustration and unhappiness.

Overall, mergers routinely create the need to deal with redundancies – it’s a fact, and should be accepted and communicated as such. Ultimately, reality will catch up with Management, and spreading a message which will be proven wrong over short or long will eat into leadership’s credibility.

Prevention strategies include:

Various reasons, from cash generation to meeting anti-trust requirements, can lead to a carve-scenario. Only: A carve-out does not just happen – it needs to be planned meticulously.

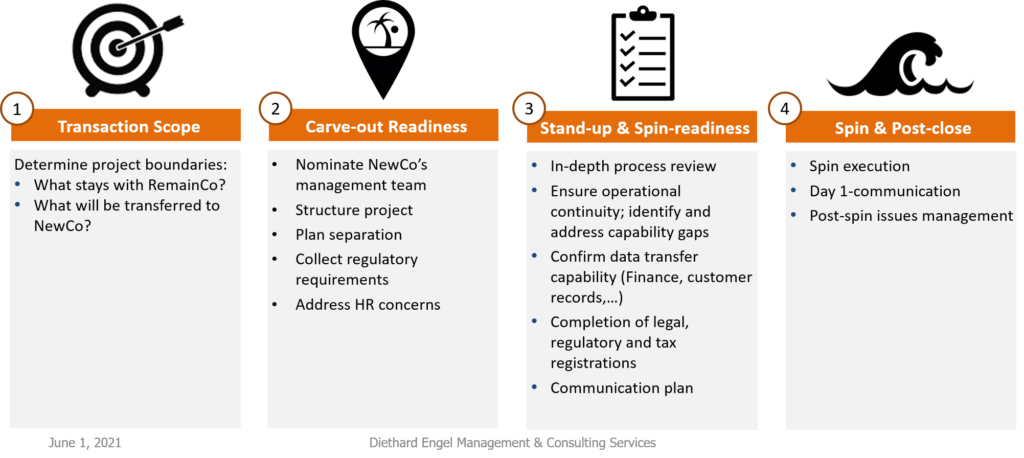

Once the strategic decision for a carve-out has been taken, planning commences: Target buyers need to be identified; competing priorities like execution speed, value and quality need to be balanced. From a purely operational point of view, however, there are a couple of steps which will lead the program manager through the schedule, depicted in the illustration below:

Initially, the boundaries of the business that shall be carved out need to be set: Locations, functions, products and services, and/or people are key determinants. In a next step, the carve-out leadership team has to be nominated. At times, not all functional management positions required for the new business can be filled from within. Given the time constraints of such a project, interim management can be a resourcing option if immediate external recruitment is not feasible. Just like in any other strategic project, the carve-out team needs to take shape, and the project should be structured into an execution team (functional management plus support team) and a steering group. Timing and objective of the carve-out should be set, as should the project governance (decision making processes, conflict & priority management, resourcing….).

People are the heart of any business, and people concerns need addressing early on. HR plays an important role throughout the project execution cycle, and should be staffed adequately. Change management know-how helps, together with a good communication plan for internal and external addressees (communication, however, is certainly not solely a HR task).

In the next step, the new business‘ operational readiness becomes the focal point: Functional processes should be reviewed and listed, including any interfaces with adjacent functions and hand-over points. Transitional/Temporary service agreements (TSA) should be prepared for those functions and processes which will not carry over into the new entity. Any capability gaps (functionally and resource-wise) need to be identified and addressed, either through TSAs, external services, or internal capability build. Furthermore, the new company need to be registered (court of commerce, tax, any other regulatory bodies).

IT and Business Systems represent a relatively large risk: Systems may be sustained, separated, relieved, and data potentially transferred, adapted, changed, deleted. Data and systems are key components in a spin-readiness assessment.

Eventually, Day 1 is going to be there. I have yet to see a spin that would take place without any issues: There is always something that was forgotten, that goes wrong or at least not as planned. The carve-out team should be set up for some post-spin issues management. Some issues only surface with delay, during a closing cycle, for example. Continuous monitoring of systems and detection of unusual process behavior are crucial in this stage.

While the above describes some common steps and activities, all carve-outs are different: Differently sized, different complexity, different people. There is no one-size-fits-all approach, and there is no predetermined timeline either. I recommend developing the detailed program in a reconnaissance phase together with Management. As a side effect, this also triggers early Management involvement. Getting Management buy-in to the approach, a commitment to objectives and eventually the timeline is crucial for a high caliber project like a carve-out in any case.

Carve-outs are predominantly transformation and change programs. My recommendation would be to look for a project manager with relevant transformation experience, rather than look for an industry insider lacking the project and process management know-how.

Getting a grasp on corporate culture is difficult, but ignoring culture can destroy value.

A common mistake in post-merger integration is the underestimation of cultural differences between the acquirer and the acquiree. If employees cannot identify with the new organization, and a „It doesn‘t work like this here!“-mentality is spreading, the risks of customer neglect and ultimately business failure are increasing.

Triggers may be the abolishment of dear symbols and brands, or the change of policy, rituals or processes without proper communication. And we all know: People get really mad if you take their perks away.

Prevention strategies include:

I have published my experience from numerous PMI projects in a small booklet, available to any interested party as a free download. It should help anyone involved in a PMI project to identify some core elements in project organization and operation. Let me know what you think.

Managing a post-merger integration is a mammoth task. Integrating everything is not a requirement.

Objectives should be challenging – no doubt. The objective to integrate an acquired business in full may be a little too much, though: Full integration is rarely required to achieve the major acquisition goals, and is usually only asked for if a clear business strategy has not been formulated.

A full integration approach is less targeted than a focused strategy, and often leads to a scenario in which everybody integrates something, but nobody understands the true integration objective and benefit. A lack of prioritization of integration goals will inevitably lead to resource issues, and resource issues lead to frustration. A thought-through change concept does not exist. Consequently, the organization will be very busy, but likely also another example for an unsuccessful integration attempt.

Prevention strategies include:

ROI hinges on investment amount, future income flow, and time. The latter tends to get ignored.

More often than not, I get called to support a project that is past due already. At the time I arrive on site, management has realized that the original timeline cannot be met, and that integration progress and synergy delivery are delayed. In other words: The original timeline is shot, with the knock-on effect that the entire financial model does not work anymore.

Mostly, a lack of planning during due diligence can be identified as the root cause: The effort linked to integration is larger than anticipated, there is no structured project management or controlling, risks and progress (or the lack thereof) are not clearly communicated. In addition, frequently day-to-day business and integration work are not properly aligned, leading to competing priorities.

There are, however, a few things management can do to avoid this scenario: